georgia ad valorem tax motorcycle

Filling Out the Georgia Title Transfer Form. Ad valorem taxes are due each year on all vehicles including vehicles that are not operational even if a tag or registration is not being applied for.

Georgia Vehicle Sales Tax Fees Calculator Find The Best Car Price

Georgia requires minimum-liability insurance on all motor vehicles.

. Tax amount per unit for vessels. Individuals are exempt from real estate tax if the property is not used for business purposes or rented out. The State of Georgia does not register or title the following vehicles.

If you are registering during the registration period for that vehicle you will need to pay the ad valorem tax due at this time. This state changed its laws in 2013. 03-8 yuan per non-motored vehicle per quarter.

County taxes or surcharges. There is a designated area to list first second and third choices for the plate. South Dakota -d ə ˈ k oʊ t ə.

August 31 2022 4. Upon payment of all ad valorem taxes and other fees due at registration of a motor vehicle an eligible family member may apply for a Gold Star license plate. Annual ad valorem tax for vehicles purchased before 31213.

There may be additional fees for listing any lien holders ad valorem taxes and other fees for processing. Download Certification of Inspection by a Duly-Constituted Georgia City. 03- 11 yuan per net tonnage per quarter.

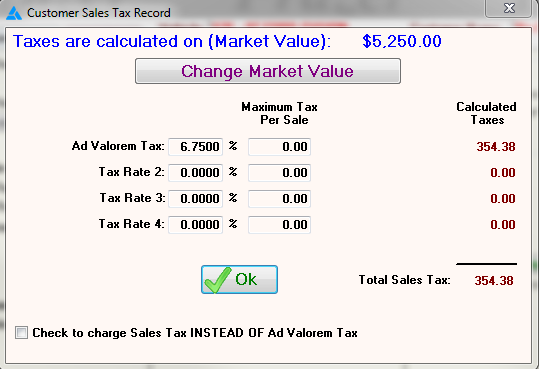

Valid drivers license or picture ID. 66 title ad valorem tax TAVT. For an estimate use the MVDs ad valorem tax calculator.

Veterans with a 100 percent service-connected disability rating are exempt from ad valorem taxes on one vehicle. 5-20 yuan per motorcycle per quarter. Military Annual Ad Valorem Tax Exemption PT-471.

25 emissions inspection in Atlanta area. There is an 18 title fee and a 20 license plate fee. See the Tax Exemptions section License Plates.

Allstate also offers insurance for your home motorcycle RV as well as. Vehicles Not Registered or Titled in Georgia. State in the North Central region of the United States.

AD Ports Groups 140 million Acquisition of a Stake in International Associated Cargo Carrier. Get 247 customer support help when you place a homework help service order with us. You can calculate what the ad valorem tax will be for your car with thisuseful Georgia Title Transfer Fee Calculator.

This applies to one vehicle registered to 100 Service Connected Veteran Purple Heart Medal of Honor Prisoner of War or Surviving Spouse of POW. One exception to the state sales tax collection is Georgia. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

Abou Ghaly Motors Financing Round. Payment of ad valorem taxes is a prerequisite to receiving a tag or renewal decal. House of Representatives 1102 Longworth House Office Building Washington D.

KL Gates Adds Tax Partner in Shanghai. Verify your motorcycle or scooter is road-worthy. 4-15 yuan per net tonnage per quarter for cargo vehicles.

Ad Valorem Tax Due Ad Valorem Tax Due. The State of Georgia does not register the following tractors and trailers. This form is completed when requesting the manufacture of a prestige license plate for a motor vehicle or motorcycle.

Dakȟóta itókaga pronounced daˈkˣota iˈtokaga is a US. After which it is important that you refer to our funding. Based on the market value of your motorcycle.

3 for new Georgia residents. Based on weight 12 minimum 5. CRITERIA for CAMPAIGNTOUR of DUTY and MILITARY MEDAL AWARD LICENSE PLATES.

Instead of sales tax car owners pay a one-time Title Ad Valorem Tax as the vehicle gets titled. One free license plate shall be allowed for the spouse mother and father and they may purchase additional license plates for each motor vehicle they register in this state. All other tags are subject to applicable taxation.

Ordering a Special Tag. Non-Resident Service Members Affidavit for Title Ad Valorem Tax on Motor Vehicles PT-472NS document seq 000. September 13 2022 4.

200 annual alternative-fuel fee. We would like to show you a description here but the site wont allow us. Urban and township land-use tax.

Charles Pol has 1 employees at this location and generates 81867 in sales USD. It is also part of the Great PlainsSouth Dakota is named after the Lakota and Dakota Sioux Native American tribes who comprise a large portion of the population with nine reservations currently in the state and have. Odometer Discrepancy Affidavit T-107 document seq 000.

A trailer weighing less than 3500 pounds used exclusively to haul agricultural products from one place on the farm to another or. Ad valorem tax is a value tax that is assessed annually and must be paid at the time of registration. Bronstein Zilberberg Chueiri and Potenza team up to form a new Law Firm.

The annual tax rate is 12 of the original value of real properties and a tax reduction of 10 to 30 is commonly offered by local governments. Active military stationed in Georgia. Alternatively tax may be assessed at 12 of the rental value.

According to the Georgia Department of Revenue owners must pay this even when vehicles change hands or move into the state. Ad Valorem tax exemption either annual property or title tax.

Form Pt 471 Fillable Service Member S Affidavit For Exemption Of Ad Valorem Taxes For Motor Vehicles

Frazer Software For The Used Car Dealer State Specific Information Georgia

New Georgia Lease Laws Milton Martin Toyota Gainesville Dealership

Georgia Title Ad Valorem Tax Updated Youtube

Georgia Motor Vehicle Ad Valorem Assessment Manual

What Are Ad Valorem Taxes Henry County Tax Collector Ga

Georgia Used Car Sales Tax Fees

Motor Vehicle Division Georgia Department Of Revenue

Form T 146 Fillable Irp Exemption To Title Ad Valorem Tax Fee Application

Business Personal Property Tax Return Augusta Georgia Property Tax Personal Property Tax Return

2013 Vehicle Valuation Manual Title Ad Valorem Tax Diminished Value Of Georgia

Georgia Department Of Revenue A Motor Vehicle Division Title Ad

Are There Any States With No Property Tax In 2021 Free Investor Guide Property Tax South Dakota States